The recent acquisition made by the Hyperliquid Assistant Fund, where they purchased over 200,000 HYPE tokens at an average rate of $21.22, totalling $4.2 million, has caused quite a stir in the market.

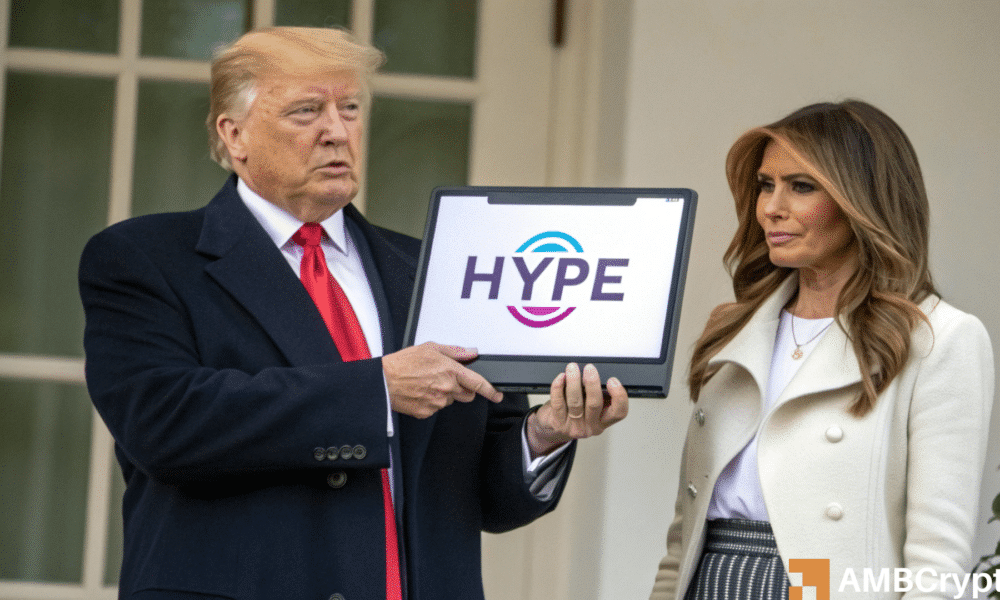

This move has coincided with Hyperliquid’s listing of politically inclined tokens, TRUMP and MELANIA, marking a significant milestone for the exchange.

The introduction of these tokens has had a profound impact on the memecoin sector, leading to a remarkable increase in Hyperliquid’s trading volumes, reaching nearly $20 billion within just a day.

This surge is also being driven by various external factors such as the growing trend of speculative trading and narrative-focused cryptocurrencies.

Influence of TRUMP and MELANIA Tokens on HYPE

The inclusion of TRUMP and MELANIA tokens has been a game-changer for Hyperliquid in recent times.

These tokens have been successful in initiating discussions and utilizing geopolitical narratives to spark interest, establishing Hyperliquid as a primary platform for such assets.

Furthermore, these listings signify a broader pattern: the rising significance of socially and politically inspired tokens in shaping the dynamics of the cryptocurrency market.

By embracing this trend, Hyperliquid not only set itself apart from its competitors but also tapped into a speculative market segment hungry for lucrative opportunities.

As discussions around crypto adoption gain momentum among political figures, these tokens might maintain their popularity. Trump’s positive stance on crypto could also impact wider adoption, potentially driving more demand for related assets.

Hyperliquid has cemented its position by recording an impressive $20 billion in trading volume within 24 hours.

This substantial surge in volume highlights Hyperliquid’s ability to attract significant liquidity, largely due to the buzz surrounding TRUMP and MELANIA tokens.

The sharp surge in volume indicates speculative trading by traders looking to capitalize on the excitement surrounding politically linked tokens.

This aligns with broader industry tendencies, where narrative-focused tokens often trigger short-term trading frenzies.

Hyperliquid’s trading volume might stay high as long as the market continues to display interest in memecoins and politically themed tokens.

Can Hyperliquid Expect More User Engagement?

The number of active wallet addresses has notably increased for Hyperliquid, indicating a rise in user activity following the introduction of TRUMP and MELANIA tokens.

This surge reflects a boost in retail participation, as fresh users are attracted to the memecoin frenzy. The influx of speculative traders underscores the growing allure of politically driven cryptocurrencies.

Sustaining this momentum will require Hyperliquid to consistently innovate and introduce new assets appealing to a broad audience.

If Hyperliquid keeps listing highly sought-after tokens, the number of active wallet addresses is likely to rise further.

However, a decline in speculative interest could impede this growth. Forge strategic partnerships or introduce new token offerings can help maintain user engagement in the long run.

While narrative-driven tokens offer immense growth potential, their speculative nature poses risks that Hyperliquid must handle prudently.