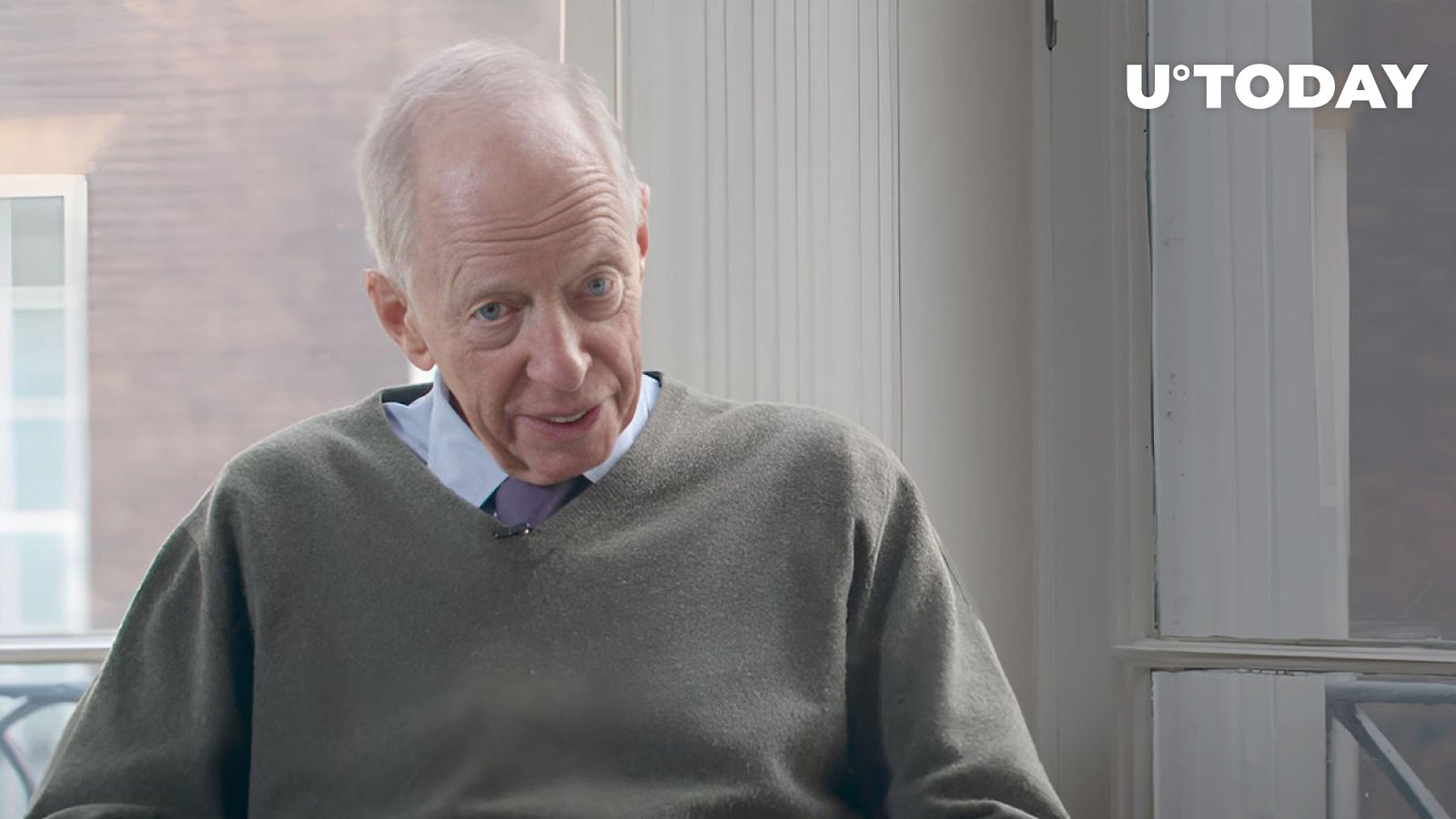

Lord Jacob Rothschild, a British nobleman, financial expert, and a member of the renowned Rothschild banking dynasty, has passed away at the age of 87. In 2019, he stepped down as chairman and director of RIT Capital Partners (formerly known as Rothschild Investments), but retained his position as the president of the investment trust until his demise.

Exploring Jacob Rothschild’s involvement in the digital currency realm with Animoca Brands, Kraken, and Paxos

It was under Lord Rothschild’s guidance that RIT Capital Partners delved into significant investments in digital currencies and blockchain startups.

The global digital currency community began to take notice in 2016 when the Rothschild family opted to diversify from the U.S. dollar into “different currencies,” sparking discussions on whether Bitcoin (BTC) could be considered a safe haven investment for renowned financiers.

While the interest in digital currencies was first publicly acknowledged in 2021, actual investments were only confirmed at this time. The venture capital arm established by the Rothschilds co-led an $8.8 million funding round for Aspen Digital, a blockchain platform based in Hong Kong.

In addition to Aspen Digital, Lord Rothschild also put funds into pioneering GameFi company Animoca Brands, the developers of the popular Web3 game The Sandbox (SAND), the high-profile centralized cryptocurrency exchange network Kraken, and Dapper Labs, the heavyweight in the NFT sector responsible for CryptoKitties, NBA Top Shot, and Flow (FLOW), a primary blockchain for digital collectibles.

RIT’s notable pivot in 2022 amidst the digital currency market downturn

While the precise amount of investments remains undisclosed, it was reported that the U.K.-based Rothschild Trust allocated 2-3% of its portfolio towards blockchain-related assets.

Furthermore, RIT Capital Partners participated in funding rounds for Paxos Global, a Web3 platform known for overseeing USDP and other well-regarded stablecoins.

As per the 2022 report, the $4.6 billion investment trust decreased its holdings in digital currency protocols by half following the market collapse triggered by the FTX/Alameda controversy.