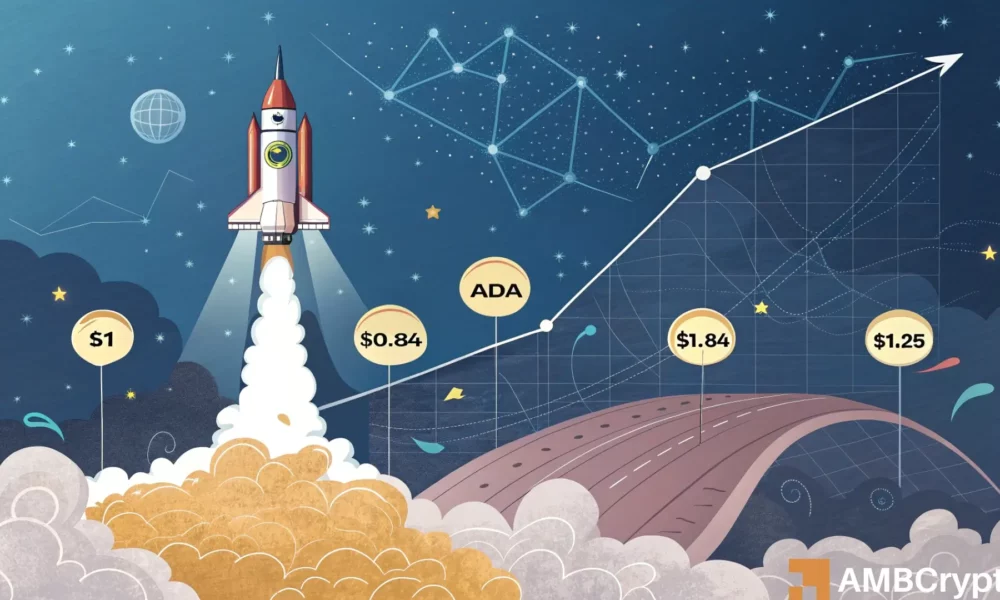

Cardano’s ADA witnessed significant volatility on the lower timeframes in recent days. The key psychological barrier at $1 aligned well with the range in which ADA has been trading for the past month.

The rejection from this resistance suggested a potential price decline in the coming days. Nonetheless, it could present an opportunity for buyers with a bullish outlook.

Analysis across Multiple Timeframes Identifies Crucial Buying and Selling Levels for Cardano

On the weekly timeframe, a notably bullish trend was observable for Cardano. The resistance around $0.787 was breached and subsequently tested as a support level. Currently, the $1 range poses a challenge for potential buyers.

During January 2022, the $1.04-$1.14 range acted as a local resistance, alongside the $1.246 level. In the upcoming weeks, these levels are anticipated to be critical resistance points for ADA bulls. However, positive momentum was evident based on the readings from the Awesome Oscillator. Furthermore, the CMF indicated significant capital inflows in recent weeks.

On the daily timeframe, a range pattern was identified. Spanning from $0.84 to $1.12, with the mid-point at $0.98, this range has alternated between support and resistance over the past six weeks, rendering the pattern more reliable.

Beneath the range’s lower limits lies the higher timeframe support at $0.787. Following Cardano’s rejection at the mid-range level in recent days, a potential drop towards $0.84, and possibly as low as $0.78, could be expected in the near future.

The CMF on the daily chart indicated a value of -0.17, underscoring significant selling pressure. Additionally, the Awesome Oscillator displayed a bearish crossover, reinforcing the likelihood of a move towards the lower limits of the range.

On a closer look at the lower timeframes, it was observed that the short-term sentiment leaned bearish. Over the past 36 hours, Open Interest steadily declined, signaling caution among speculative traders. Although the spot CVD also experienced a minor decline, it had shown improvement compared to the previous week.

Considering the higher timeframes, it is advisable for investors not to be swayed by the lower timeframe fluctuations. A potential retracement to $0.84 or lower could present a favorable buying opportunity. Looking ahead, surpassing $1.246 in the coming months might indicate a robust price surge for Cardano.

Disclaimer: The aforementioned analysis does not constitute financial, investment, trading, or any form of advice and represents solely the author’s perspective.