Aptos [APT] is at a crucial juncture as negative indicators and diminishing interest impact its future trajectory, raising concerns of a significant price downturn.

Currently, APT is trading at $8.36, showing a 2.61% increase in the last 24 hours.

Although there has been a slight recovery, market conditions, technical trends, and social data all suggest potential further downward pressure. Can Aptos reverse its bearish path, or is a drop to $4.30 unavoidable?

The Unveiling Event: Opportunity or Threat?

By the 10th of February 2025, 11,310,000 APT tokens will be unveiled, raising the circulating supply by 1.98%.

In previous occurrences, such unveilings have triggered significant selling activity as initial investors seek to sell off tokens for profit.

This influx could test APT’s current price stability. Yet, with sustained demand, the price may hold or even draw buyers at lower levels.

Furthermore, market participants will closely monitor trading volumes to assess sentiment during and following the unveiling event.

APT’s Technical Perspective: What’s the Destination?

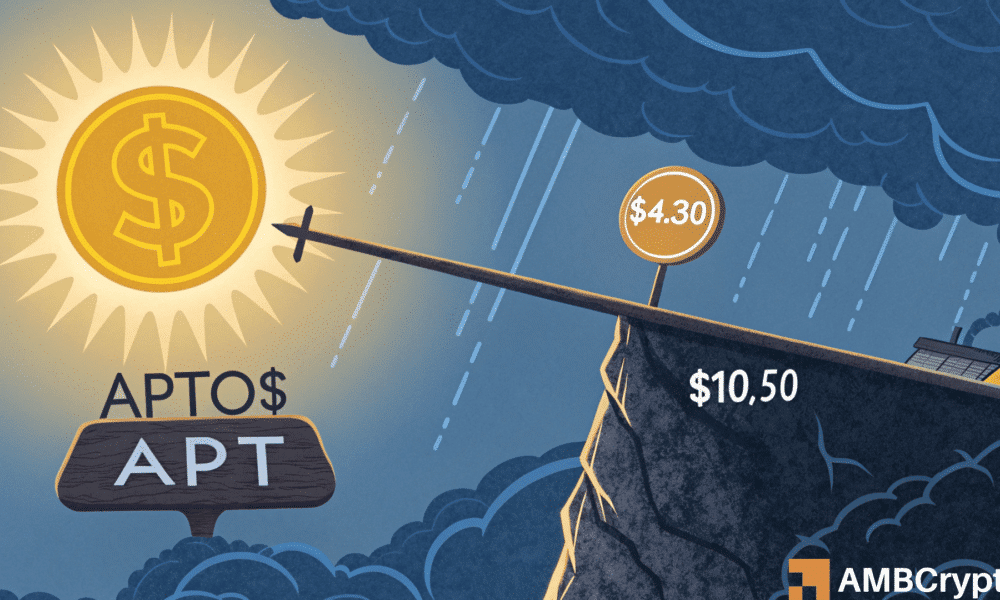

An examination of the Aptos price chart points to a recognizable head-and-shoulders pattern, hinting at potential downside movement. The $8.05 neckline is a crucial support level, and a breach would likely confirm a decline towards $4.30.

Nonetheless, a close above $10.50 could invalidate this bearish formation and revive bullish momentum.

Given the current uncertainty in price action, traders are on the lookout for a breakout or breakdown in the upcoming sessions.

Is Interest Waning?

Social metrics unveil a worrying trend for Aptos, with Social Dominance plummeting to a mere 0.064% and social volume stagnant at 4, significantly below previous peaks.

These metrics underscore diminishing interest among retail traders and the wider crypto community.

A lack of engagement may dampen sentiment, potentially exacerbating price declines. Hence, a notable surge in social activity could be pivotal in reviving APT’s momentum and enticing new investors.

Open Interest: Implications for APT

Open interest in APT Futures has dwindled to $55.79 million, indicating a sharp decrease in market involvement. This decline reflects waning confidence among traders and a lack of speculative interest in the asset.

Reduced Open Interest can curb price volatility, making the market more vulnerable to sustained downward pressure. In the absence of fresh capital inflows, the bearish sentiment is expected to linger in the short run.