President Donald Trump has initiated a significant overhaul of the US financial landscape by authorizing an executive order that paves the way for the establishment of a sovereign wealth fund.

Trump’s Vision for a Sovereign Wealth Fund

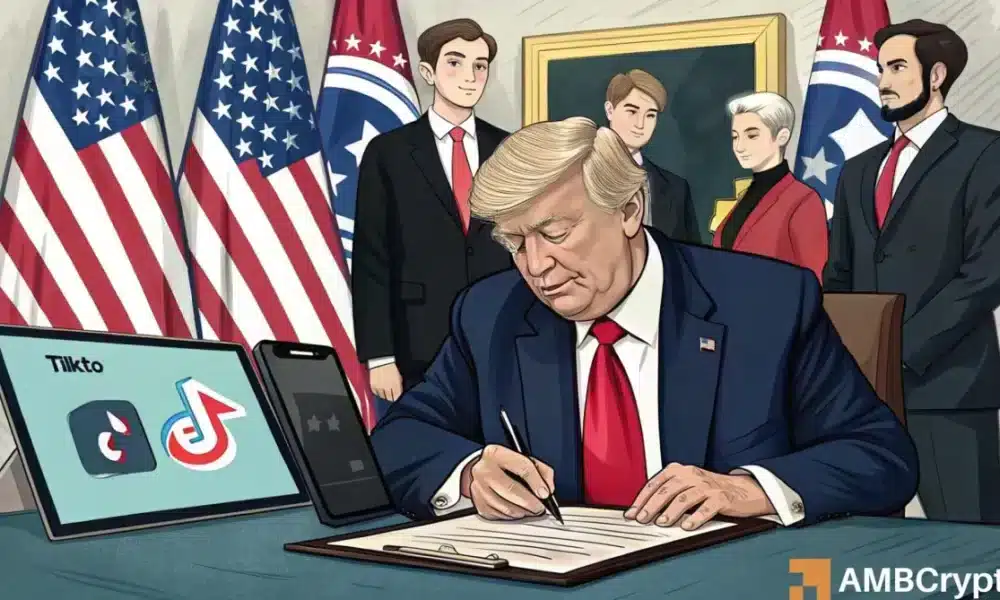

Unveiled recently, this endeavor seeks to create a government-managed investment entity that could wield influence in economic policy formulation. Noteworthy is Trump’s allusion to a potential collaboration with TikTok, the Chinese-owned social media mammoth currently under regulatory scrutiny.

His statement remarked,

“I believe that in a brief period, we could have one of the largest funds.”

During the order’s enactment, Trump underscored the potential of a US sovereign wealth fund, citing countries like Saudi Arabia, which have amassed substantial investment reserves.

Foreseen Hurdles

He referenced Saudi Arabia’s Public Investment Fund, presently valued around $925 billion, as a yardstick. While he admitted that the US trails in this aspect, Trump expressed optimism that the nation could eventually establish a competitive fund, capitalizing on its economic prowess to propel sustained financial growth and international sway.

The viability of launching such a fund, however, faces scrutiny, given the burgeoning US debt, nearing $36 trillion. Mark Crosby, the Director of Monash University’s Bachelor of International Business Program, suggested that successful funds typically arise from nations with minimal or nonexistent debt—highlighting a challenge for the United States.

“For a heavily indebted nation like the US, it might not be the most practical move.”

Biden vs. Trump

The proposal for a US sovereign wealth fund has garnered rare bipartisan endorsement, with both the Trump and Biden administrations mulling over its feasibility. Nevertheless, Trump’s nascent administration has already set itself apart from its forerunner, notably in its stance on cryptocurrencies.

Whereas the Biden administration approached the sector cautiously, Trump is lauded as the “crypto-friendly president” for his more supportive policies.

Industry Leaders Back Trump’s Administration

While a sovereign wealth fund could spur innovation, the Trump administration is also moving to relax prior restrictions on cryptocurrencies. Coinbase’s Chief Legal Officer, Paul Grewal, is slated to testify before Congress as legislators investigate claims of federal regulators pressuring banks to sever ties with crypto companies.

In his address on the issue, he articulated,

“The Congressional inquiry, dubbed Operation Choke Point 2.0: The Biden Administration’s Efforts to Put Crypto in the Crosshairs, arrives amidst rising concerns about US regulators, including the FDIC, covertly stifling crypto’s access to traditional financial services.”

Given the Trump administration’s distinctive stance on digital assets, the outcomes of these hearings hold significance in reshaping the cryptocurrency landscape within the US financial domain.