The sudden cascade of liquidation earlier today drove Ripple [XRP] to hit a low of $1.77 on the Binance platform, marking a significant 43% drop from the opening price on January 31st.

The daily chart revealed a break of the range formation seen over the past two weeks following the closure below $2.9, thereby invalidating the previously bullish outlook.

Violent Break Below Lows — What Comes Next?

The breach beneath the $2.9 level was prompted by widespread market panic and a subsequent liquidation cascade just hours before the time of this analysis.

The Relative Strength Index (RSI) plunged below the neutral 50 mark, signaling a shift in momentum, a move that was further corroborated by the price action itself.

Interestingly, the On-Balance Volume (OBV) did not establish new lows in comparison to mid-January, holding slightly above those higher lows, suggesting that the recent selling pressure did not manage to surpass the accumulation from the previous fortnight.

However, this alone did not indicate a green light for additional XRP purchases. The 4-hour chart illustrated the drop to $1.77 on Binance and the subsequent rapid recovery.

Termed as a “dead cat bounce,” rooted in the morbid notion that anything falling far enough must rebound, XRP may not be on the path to full recovery just yet.

Therefore, traders and investors might anticipate a retest of the $1.77 level in the days ahead to clear the accumulating liquidity before contemplating a bullish reversal.

How High Can XRP Rally Before Revisiting the 4-Hour Wick?

A three-month liquidation heatmap pointed towards noticeable liquidation levels around the $1.7 region, suggesting that a move towards $1.77 may see a slight dip to absorb this liquidity prior to turning around.

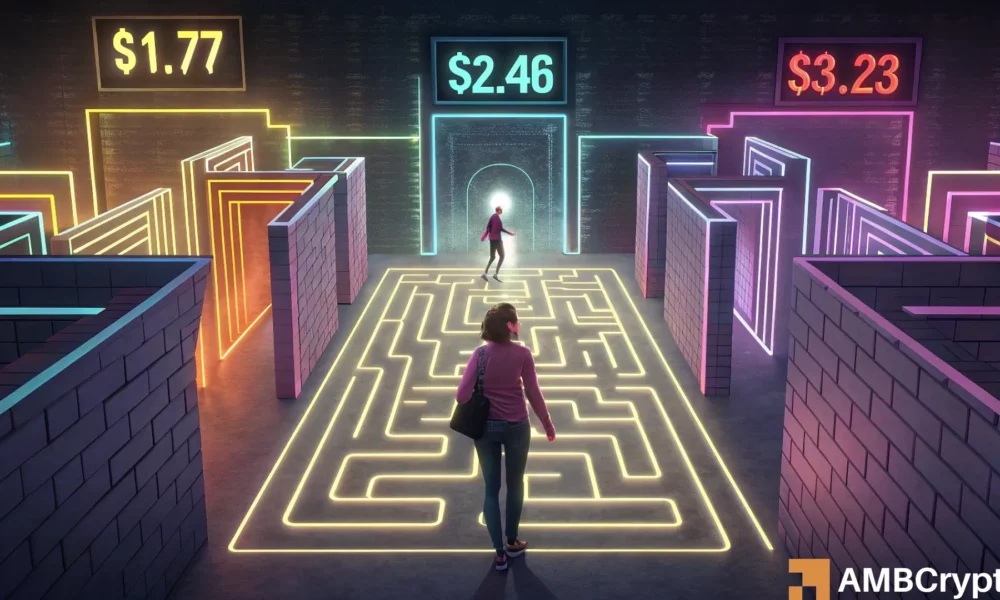

On the upside, the $3.23 level emerged as the next critical zone to monitor. A breakthrough above this level could signal a sustained higher timeframe bullish trend.

In the short run, $2.46 appears to be a feasible target for XRP in the upcoming hours. Towards the downside, the $1.92 area seemed to be accumulating a substantial number of liquidation levels, a zone that the bears might aim for in the days ahead.

Disclaimer: The content shared should not be regarded as financial, investment, trading, or any form of advice and represents the writer’s personal viewpoint.